What if the stories of your childhood weren’t just legends… but a call to action?

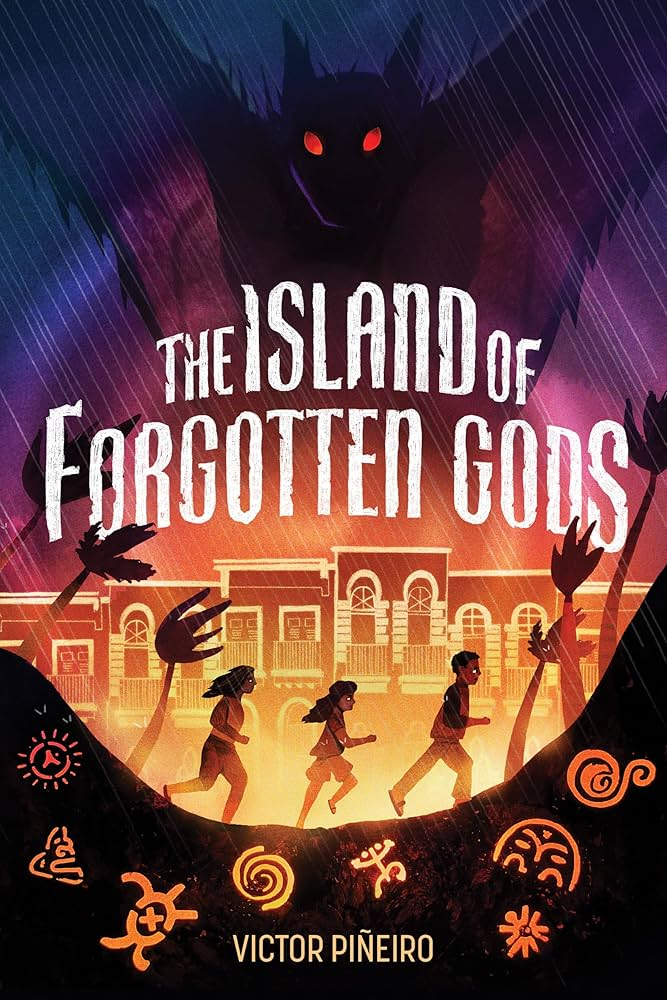

Victor Piñeiro’s The Island of Forgotten Gods is a captivating, heartfelt middle-grade fantasy that blends ancient mythology with modern challenges, all set against the lush, vibrant backdrop of Puerto Rico. Releasing August 5, this novel has already earned a starred review from Kirkus, who calls it “an action-packed story of legacy, identity, and the enduring spirit of Puerto Rico.”

Middle grade readers will be swept into a mythological adventure packed with legendary monsters, ancient gods, family secrets—and the power of reclaiming who you are.

🧃 Synopsis

Twelve-year-old Nico Rivera isn’t exactly thrilled about spending the summer in Puerto Rico with his abuela and cousins—especially after being waitlisted by the prestigious art school he had pinned his dreams on. But he’s determined to make the most of it by creating a documentary that highlights the beauty and culture of the island—and maybe even win a film festival prize along the way.

What starts as a simple summer project quickly spirals into a mythic quest when Nico is chased by the chupacabra, stumbles into long-buried family secrets, and learns that Puerto Rico’s forgotten gods are real—and furious.

With the island in danger, Nico must embrace his identity, honor his heritage, and confront the gods themselves… all while finding the courage to believe in his own story.

🎓 Why This Book Belongs in the Classroom

The Island of Forgotten Gods is a rich addition to any classroom or school library, offering the perfect mix of adventure, cultural authenticity, and emotional growth. Here’s how it shines in educational settings:

✅ Teaching Themes:

-

Cultural Identity and Heritage – Encourages students to explore their roots and what makes their personal and collective histories meaningful.

-

Storytelling and the Power of Art – Nico’s passion for filmmaking opens dialogue about how we tell stories and why representation matters.

-

Mythology and Folklore – Introduces readers to Taíno mythology and Latinx legends, broadening students’ cultural literacy beyond Greek and Norse myths.

-

Family and Expectations – Tackles relatable issues like living up to family hopes, multigenerational relationships, and defining success for yourself.

-

Resilience and Real-World Challenges – Touches on Puerto Rico’s recovery from natural disasters and economic hardships in age-appropriate ways.

📚 Teaching Ideas:

-

Mythology Match-Up: Have students compare a Taíno god from the novel with a god from another mythology they’ve studied.

-

Film Festival Project: Let students create a storyboard or script for a short film that celebrates their own culture, hometown, or family tradition.

-

Identity Journals: Prompt students to reflect on what "home" means to them and how their identity shapes their goals.

-

Debate or Discussion: Should we forget the old gods if we no longer believe in them? What are the consequences of forgetting history?

-

Cross-Curricular Connections: Use the book in social studies units on Puerto Rican history, natural disasters, or cultural resilience.

🌟 Middle Grade Read-Alikes

If your students loved these titles, The Island of Forgotten Gods is a perfect next read:

-

The Storm Runner by J.C. Cervantes – A thrilling fantasy rooted in Mayan mythology with a modern protagonist discovering his powers.

-

Sal & Gabi Break the Universe by Carlos Hernandez – A mix of heart and humor with Cuban-American leads and sci-fi chaos.

-

The Total Eclipse of Nestor Lopez by Adrianna Cuevas – Another Latinx hero, folklore-based fantasy, and themes of family and belonging.

-

City of the Plague God by Sarwat Chadda – Mesopotamian mythology meets fast-paced adventure and emotional complexity.

-

Ghost Squad by Claribel A. Ortega – A spooky, heartfelt supernatural tale infused with Dominican folklore.

💬 Final Thoughts

Victor Piñeiro’s The Island of Forgotten Gods is more than just a page-turning adventure—it’s a celebration of identity, storytelling, and cultural pride. Perfect for middle grade readers who crave myth and magic, or for educators looking to expand representation and deepen classroom conversations, this novel delivers both entertainment and impact.

Put this one on your pre-order list—it will be a standout addition to your curriculum, literature circles, or independent reading shelves.ng Puerto Rican Adventure

“An action-packed story of legacy, identity, and the enduring spirit of Puerto Rico... A vibrant blend of contemporary coming-of-age with mythological adventure.” — Kirkus Reviews, STARRED review

A bold, cinematic adventure awaits young readers in the highly anticipated new middle grade novel from award-winning author Victor Piñeiro, The Island of Forgotten Gods (On Sale: August 5). Set against the lush backdrop of Puerto Rico, this timely and thrilling tale explores the intersections of identity, legacy, and belief—wrapped in the page-turning suspense of a supernatural mystery.

From a legendary monster to ancient gods, from family secrets to cultural resilience, The Island of Forgotten Gods is a celebration of what it means to truly see where you come from—and who you are.

“The Island of Forgotten Gods is about Puerto Rico – the summers I spent there as a kid, its mythic grandeur and its current hardships. It’s a love letter to my favorite place on Earth,” says author Victor Piñeiro. “While full of action, horror and suspense, it’s also a portrait of an island on the brink. It’s about realizing that your childhood paradise has a complicated history and noticing the cracks in the paint for the first time. And it’s about preserving a culture that is being threatened on all sides.”

A Story with Cultural Resonance and Contemporary Relevance

As Puerto Rico continues to navigate the real-life effects of climate change, economic hardship, and cultural preservation, Piñeiro’s story gives young readers a vibrant lens into the island’s history and mythology. With heartfelt family dynamics, authentic dialogue, and deep roots in Taíno legend, The Island of Forgotten Gods connects readers to Puerto Rico’s past and present in ways both powerful and playful.

For Kids: Monsters, Mayhem, and Movie-Making Dreams

Nico, a hopeful young filmmaker, travels to Puerto Rico expecting a quiet summer with his iconic Abuela and chaotic cousins—but instead stumbles into a thrilling chase involving the infamous Chupacabra, a secret cult, and gods older than the island itself. With humor, heart, and just enough fear to keep the lights on, readers will be hooked by the high-stakes adventure, laugh-out-loud moments, and the idea that storytelling itself can change the world.

For Adults: A Book Worth Recommending—and Reading Alongside

Teachers, librarians, and parents will find The Island of Forgotten Gods a compelling read-aloud and discussion starter, thanks to its rich cultural themes, authentic emotional arcs, and thoughtful exploration of identity, art, and family expectations. With an author’s note, map, and glossary, it’s also a natural fit for classrooms, book clubs, and readers hungry for books that reflect diverse heritages and lived experiences.

Victor Piñeiro has led digital innovation at HBO Max, run social media for @YouTube and launched @Skittles. He's also designed games for Hasbro, written and produced an award-winning documentary on virtual worlds, and taught third graders. He is the author of Time Villains and Monster Problems. Check him out on Instagram.

Praise from Early Reviews:

“An action-packed story of legacy, identity, and the enduring spirit of Puerto Rico... A vibrant blend of contemporary coming-of-age with mythological adventure.” — Kirkus Reviews, STARRED review

“Piñeiro’s newest fantasy is a beautiful and exciting love letter to Puerto Rico.” — Booklist

The Island of Forgotten Gods

By Victor Piñeiro

On Sale: August 5, 2025

Sourcebooks Young Readers

ISBN: 978-1-7282-30559 | 978-1-4642-37980

Hardcover | $16.99

Paperback | $8.99

Ages 9–13 | Juvenile Fiction; Fantasy / Adventure / Mythology